Institutional investors are injecting billions into Bitcoin ETFs for the second week in a row, propelling the reigning cryptocurrency to three-month highs. Is a new bull run on the horizon?

The pioneering cryptocurrency is roaring back. For the second week in a row, Bitcoin exchange-traded funds (ETFs) recorded positive net capital inflows, reaching an impressive $1.805 billion, according to data revealed by Coinglass. This torrent of institutional investment provided solid support for the Bitcoin price, allowing it to break through the crucial resistance zone of $95,000 in the past week.

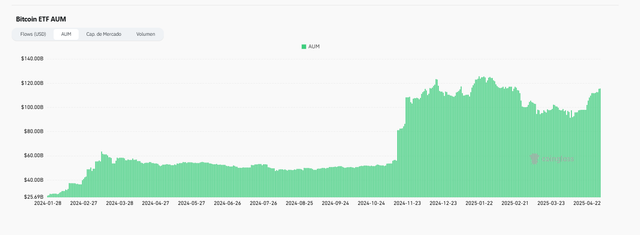

An increase in AUM means that the total amount of assets investors have entrusted to Bitcoin ETFs is growing. / Coinglass

Massive Institutional Investment Drives AUM to New Highs

The appetite of institutional investors for Bitcoin exposure through ETFs is undeniable. Digital assets under custody (AUM) in these financial instruments climbed to a three-month high, reaching a staggering $115.53 billion.

An increase in AUM means that the total amount of assets investors have entrusted to Bitcoin ETFs is growing. This can be due to both new capital inflows and appreciation in the price of Bitcoin itself, which is generally interpreted as a sign of increased confidence and institutional adoption.

This significant recovery in AUM marks a turning point after three months of fluctuations and, at times, declines in the cryptocurrency's price, suggesting renewed interest and a more optimistic outlook on the part of large investors.

Bitcoin ETF Market Cap Regaining Momentum

The impact of this positive capital inflow was directly reflected in the market capitalization of Bitcoin ETFs, which also saw a substantial increase, reaching $114.90 billion. This notable increase represents the highest level of Bitcoin ETF market capitalization since February 21, 2025.

The halt in the downward trend in Bitcoin ETF market capitalization, following this new price rally, fuels speculation that the leading cryptocurrency could be entering a promising new phase of recovery, once again attracting the attention of investors of all sizes.

Solid Trading Volume Supports the Bullish Movement

The strength of Bitcoin's recent bullish movement is reinforced by a considerable increase in ETF trading volumes. These volumes have consistently remained above the levels recorded since March 13, indicating that the inflow of capital is not speculative, but is supported by significant trading activity and genuine interest in accumulating Bitcoin through these instruments.

Mixed US Jobs Data Halts Slight Rally

Despite the strong momentum generated by ETF inflows, the Bitcoin price moderated somewhat at the close of the week in the United States. The release of mixed jobs data, with nonfarm payrolls slightly higher than expected last Friday, although still below the previous figure, generated some caution in the markets and halted further price increases. The world's leading cryptocurrency is currently trading around $95,943.

The steady flow of institutional capital into Bitcoin ETFs for two consecutive weeks, boosting AUM to three-month highs and bolstering market capitalization, paints a bullish picture for the reigning cryptocurrency. Despite a slight slowdown from US jobs data, the breakout of the key resistance at $95,000, supported by solid trading volume, suggests that Bitcoin could be preparing for another attempt at higher levels. Investors will closely monitor the evolution of ETF flows and macroeconomic indicators to confirm whether this bullish awakening has the necessary strength to consolidate.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Cryptocurrency trading is highly volatile and carries significant risks of capital loss. Please conduct your own research before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit