Medium-term investors are aggressively increasing their Bitcoin holdings to November 2024 highs, as the reigning cryptocurrency regains $95,000 after the tariff truce. Is a new era of accumulation on the horizon?

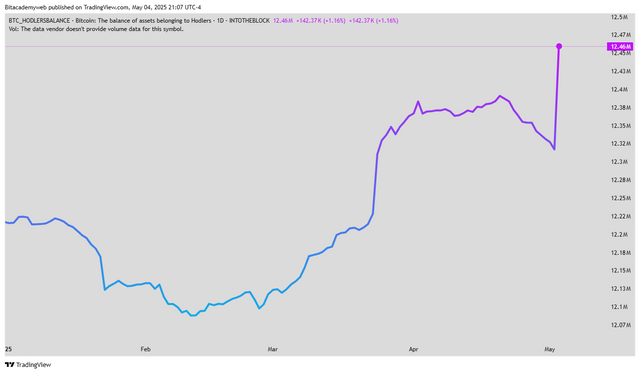

Bitcoin holders, those investors with a medium-term view (between three and seven years), have once again demonstrated their unwavering confidence in the world's leading cryptocurrency. According to on-chain data from IntoTheBlock, they accumulated Bitcoin tokens at levels not seen since November 2024. So far in 2025, their positions have grown 1.99%, reaching an impressive 12.46 million coins. The most significant boost was recorded in the last week, with an increase from 12.32 million BTC to 12.46 million BTC between May 1 and 4.

The aggressive accumulation of Bitcoin by holders, coupled with the price's recovery above $95,000, suggests increasingly optimistic market sentiment. / TradingView

An aggressive increase in BTC holdings by holders suggests a strong conviction in the cryptocurrency's long-term potential. These investors, who have historically proven less likely to sell in the face of short-term volatility, see current conditions as an opportunity to strengthen their positions, which is often interpreted as a bullish sign for the future price.

Traders Recover Lost Ground, Cruisers Adjust Positions

While holders increase their Bitcoin holdings, traders (investors with holdings between one and three years) have managed to recover some of the coins they had lost since the beginning of the year. Their holdings increased from 1.61 million BTC to 2.68 million BTC, marking a recovery from the low of 1.26 million BTC recorded in March.

On the other hand, "cruiser" or extremely long-term investors (seven to ten years) have seen an increase in their BTC positions so far this year, rising from 4.93 million to 5.82 million BTC. However, this group has slightly reduced their holdings since the peak of 6.43 million BTC reached in late February.

Tariff truce and dollar weakness drive recovery

After a price correction triggered by uncertainty surrounding Donald Trump's tariffs and the Federal Reserve's stance on not cutting interest rates in the first quarter, Bitcoin has staged a notable recovery. The announcement of a tariff truce against 75 countries and rumors of secret negotiations between China and the United States, coupled with the weakness of the US dollar, have acted as catalysts for the Bitcoin price to rebound to $95,000 in the last week.

The aggressive accumulation of Bitcoin by holders, coupled with the price's recovery above $95,000, suggests increasingly optimistic market sentiment. The tariff truce and the weak dollar eased some of the bearish pressure, allowing long-term investor confidence to translate into increased demand. While traders are showing signs of recovery and cruisers are adjusting their positions after reaching highs, the strong accumulation by holders is a fundamental signal of belief in Bitcoin's medium-term potential. Investors should closely monitor macroeconomic developments and the behavior of different groups of holders to determine the sustainability of this renewed bullish momentum.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Cryptocurrency trading is highly volatile and carries significant risks of loss of capital. Please conduct your own research before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit