Introduction

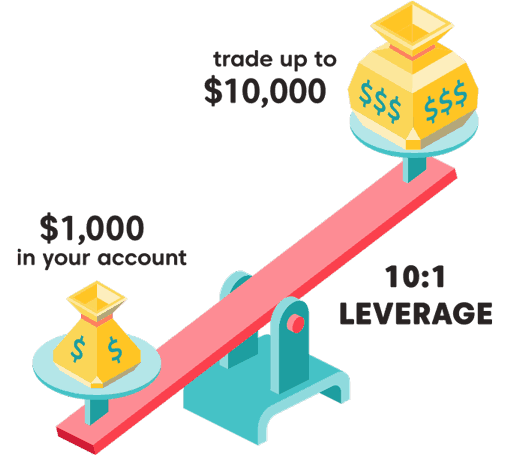

Leverage is a powerful tool used by forex traders to control larger positions with a smaller amount of capital. However, it is a double-edged sword — it can magnify profits, but also amplify losses.

How Does Leverage Work?

For example, with a leverage of 1:100, every $1 in your account allows you to open a position worth $100. That means $100 lets you trade $10,000.

Pros and Cons of Leverage

Advantages:

- Greater buying power

- Potential for high profits with low capital

Disadvantages:

- Amplifies losses

- High risk of account liquidation if risk isn't managed

Key Tips

- Avoid using maximum leverage, especially as a beginner

- Always use a stop loss

- Choose leverage that fits your strategy and risk tolerance

Conclusion

Leverage can be your friend or foe in the forex market. Use it wisely, and always remember: risk management is more important than profit potential.