On-chain data shows, despite supply being unlimited, the recent Shapella Ethereum upgrade has resulted in:

Reduction in validators means significant drop in ETH issuance

Increased in liquid staking and other network activities which leads to more ETH being burnt via EIP1559

Increased usage of ETH and stablecoins with token-related gas usage rising by 8.2% and stablecoin gas usage up by 19%

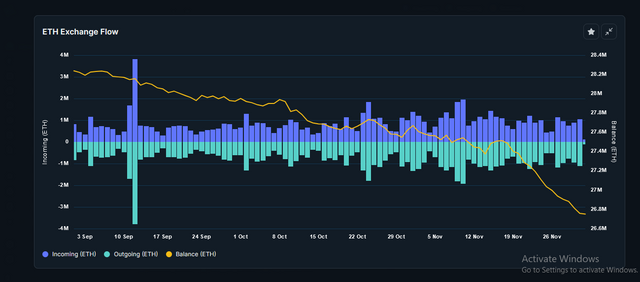

Also, data extracted from Nansen.ai supports this analysis with charts showing a sharp increase in the outflow of ETH from exchanges indicating either of the following:

Transfer for self-custody

Staking

Gas fee usage

With these, we can confidently say that ETH has moved from being inflationary to being deflationary indicating an uptrend in price from $1500 to $2100 and analysts have predicted a continuation in the surge of its price. Also, with the ETH spot ETF applications about to be approved by SEC, a big surge may ensue, but that's still speculative.

Overall, the market sentiment looks bullish considering all other factors and it might be just time to scoop in more ETH before the price surge. Consider this NFA!