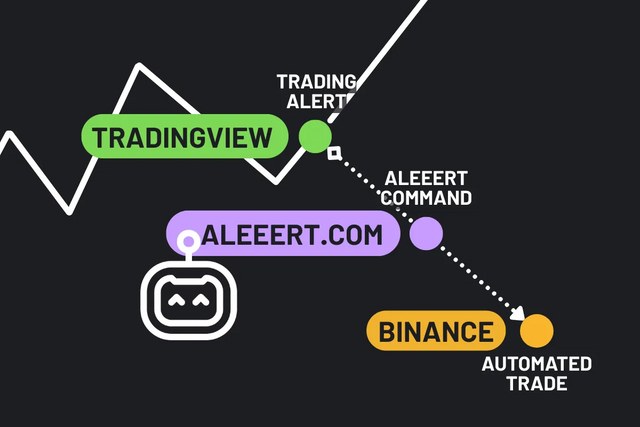

In the fast-paced world of trading, automation can enhance both efficiency and accuracy. Aleeert.com offers a seamless solution to connect TradingView alerts with Binance, allowing traders to automate their trading strategies effortlessly. This article will guide you through setting up this integration and explain the types of orders you can automate.

What is Aleeert?

Aleeert.com is a versatile tool that bridges TradingView and Binance. It converts TradingView alerts into actionable orders on Binance, enabling traders to execute their strategies in real-time without manual intervention. This automation helps capture profitable opportunities and manage trades more effectively.

Setting Up Aleeert with TradingView and Binance

- Create an Account on Aleeert: Sign up for an account on Aleeert.com and link it to your Binance account using API keys.

- Set Up TradingView Alerts: In TradingView, create alerts based on your preferred technical indicators or price levels.

- Add Aleeert Command: Include the Aleeert command in the alert message field to specify the order type and parameters.

- Add Aleeert Webhook URL: Enter the provided Aleeert webhook URL in the alert settings to ensure alerts are sent directly to Aleeert.

Types of Orders You Can Automate

Aleeert supports various types of orders, allowing you to tailor your trading strategy effectively:

1. Market Order

A market order executes immediately at the current market price. This is ideal for traders looking to enter or exit a position quickly. With Aleeert, you can set TradingView alerts to trigger market orders based on specific conditions, ensuring swift execution.

2. Limit Order

A limit order allows you to specify a price at which you want to buy or sell an asset. This order is executed only if the market reaches your specified price. Using Aleeert, you can automate limit orders from TradingView alerts, enabling you to capitalize on favorable price movements.

3. Trailing Stop

A trailing stop order is designed to protect gains by keeping a trade open and profiting as long as the market price is moving favorably. If the market price reverses by a specified amount, the trailing stop order will close the trade. Aleeert can automate this feature based on your TradingView alerts.

4. Stop Loss

A stop-loss order automatically closes a position when the market price reaches a certain level, helping limit potential losses. By setting up alerts in TradingView, you can instruct Aleeert to place stop-loss orders on Binance, ensuring effective risk management.

5. Take Profit

A take-profit order locks in profits by closing a position once it reaches a predetermined price. This can be automated through Aleeert, allowing you to set alerts in TradingView that trigger take-profit orders on Binance.

Benefits of Automation with Aleeert

- Efficiency: Automating trades saves time, allowing you to focus on strategy development rather than execution.

- Precision: Automated orders minimize the risk of human error, ensuring trades are executed as planned.

- 24/7 Trading: Aleeert enables your trading to continue even when you’re not actively monitoring the markets.

Conclusion

Integrating TradingView with Binance through Aleeert.com transforms your trading approach by automating order execution. With the ability to utilize market orders, limit orders, trailing stops, stop losses, and take profits, traders can implement complex strategies with ease. This automation enhances efficiency and helps manage risks, making it an invaluable tool for both novice and experienced traders. Start leveraging the power of automation today and elevate your trading game!