Bitcoin's price is approaching a key threshold for short-term holders as negative funding in futures portends a potential bullish squeeze. Heading to $100,000 or an imminent correction?

Bitcoin (BTC) is at a critical crossroads, currently trading at $92,773, dangerously close to the average cost of short-term holders (STH) of $93,000. This level not only represents immediate technical resistance but also a psychological inflection point that could trigger a significant price movement for the leading cryptocurrency. Technical and sentiment indicators offer a neutral outlook with a marked bullish bias, anticipating a potential explosion of volatility.

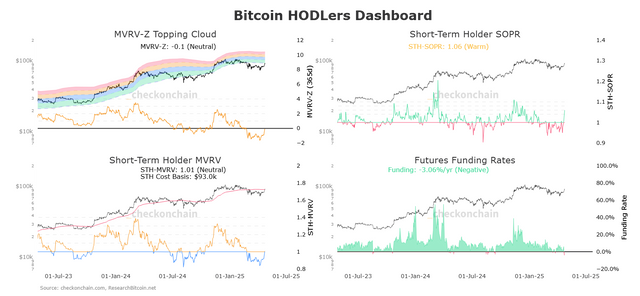

One of the most intriguing indicators is the futures funding rate, which currently stands at -3.06% annually / CheckonChain

Key Indicators Signal Calm Before the Storm

Analysis of several key indicators reveals a market in balance, but ready to react, according to data from CheckonChain. The MVRV-Z, which assesses Bitcoin's valuation relative to its historical average, stands at -0.1, indicating a neutral zone where BTC is neither overbought nor oversold. This suggests the absence of extreme signs of panic or widespread euphoria.

Meanwhile, the Short-Term Holder MVRV, which measures short-term investors' profits, stands at 1.01, showing that these holders are slightly in profit, albeit without excessive enthusiasm. The crucial data point lies in the STH Cost Basis of $93,000, which acts as immediate resistance. Breaking above this level could spark a bullish breakout.

The STH-SOPR, which tracks profits realized by short-term holders when selling, stands at 1.06, meaning they are selling with small profits of 6%. While this indicates moderate profit-taking, it does not suggest a massive distribution that could significantly pressure the price downward. However, traders should be on the lookout for potential buyer fatigue if the SOPR continues to rise without sustainable upward momentum.

Negative Funding in Futures: Fuel for a Potential Bullish Squeeze

One of the most intriguing indicators is the futures funding rate, which currently stands at -3.06% annually. This negative value implies that shorters (short sellers) are paying longers (long-term buyers). Historically, this situation often precedes bullish rebounds, as short sellers are forced to close their positions to limit losses, generating additional buying pressure known as a short squeeze. If the price manages to break the $93,000 barrier, a bullish squeeze becomes highly probable.

Battle at $93,000: The Level That Sets the Course

The STH Cost Basis of $93,000 stands as the key battleground for Bitcoin in the short term. If the cryptocurrency manages to break through and hold this level with significant trading volume, it could trigger a wave of FOMO (fear of missing out)-driven buying among short-term holders, driving the price towards the $96,000–$100,000 level.

On the other hand, if the price rejects this level, we could see a short correction towards the psychological support zone of $89,000–$90,000, where buyers could find an opportunity to accumulate before a new attempt to break above the resistance.

The Bitcoin market is at a crucial inflection point, with the price hovering around the STH Cost Basis of $93,000. The combination of neutral sentiment and negative futures funding tips the balance toward a bullish scenario. Holders should remain calm and closely monitor price action around this key level, while traders should look for confirmation of a breakout with solid volume or a possible rebound from the support zone. Volatility could increase significantly in the coming hours, defining Bitcoin's next explosive move.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Cryptocurrency trading is highly volatile and carries significant risks, including the total loss of your invested capital. Consult a financial advisor before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit