Market Overview

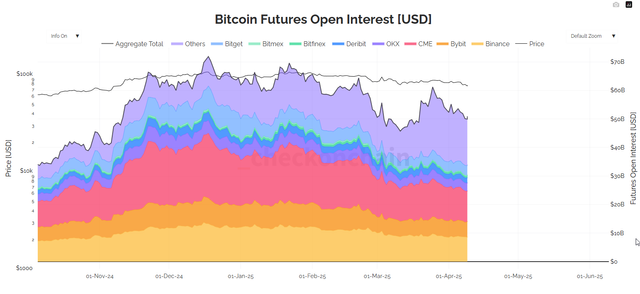

The Bitcoin market, analyzed through the evolution of Open Interest (OI) in futures, price, and associated volume, reveals a progressive deleveraging trend within a predominantly bear market during the period from December 2024 to April 2025.

A sustained decline in Open Interest is observed in Bitcoin / CheckonChain

Key Trends and Patterns

Steady Decline in Open Interest: A sustained reduction in Open Interest is observed in Bitcoin futures. From a high of $71.85 trillion on December 18, 2024, coinciding with a price of $106,120, OI steadily declined until reaching $50.90 trillion on April 9, 2025, with a significantly lower price of $76,317. This -29.2% drop in OI suggests an outflow of speculative capital and lower participation in the derivatives market.

Correlation between Price and Deleveraging:The decline in OI has been accompanied by a downward trend in the Bitcoin price, with a -28.1% drop during the analyzed period. This indicates that position liquidation and investor caution have exerted downward pressure on the price.

Erratic Volume with Significant Recent Spike: OI trading volume has fluctuated considerably. A low of $66.40 trillion was recorded on February 21, 2025, when OI stood at $64.35 trillion and the price at $98,252. However, the most recent data, from April 9, 2025, shows a peak volume of $116.76 trillion, coinciding with the lowest OI of the period ($50.90 trillion) and a price of $76,317.

Critical Data Analysis

The Peak Volume with OI at Lows (April 9, 2025)

The most relevant data point at the moment is the combination of exceptionally high trading volume and Open Interest ($116.76 trillion) with the lowest Open Interest level of the period ($50.90 trillion), all within a context of a declining price ($76,317).

This pattern suggests a possible capitulation phase. The high volume could indicate a sell-off, possibly driven by fear or the liquidation of remaining positions, while the low OI reflects a significant reduction in leverage and speculative interest in the futures market. Traditionally, a volume spike in a bear market with declining OI can signal the exhaustion of selling pressure and potentially precede a technical rebound, although it does not guarantee a long-term trend reversal.

Relevant Figures

The sharp drop in OI from $71.85 trillion to $50.90 trillion demonstrates a clear decline in risk appetite and leveraged speculation.

The price decline from $106,120 to $76,317 validates the overall bearish pressure in the market.

The volume spike of $116.76 trillion at the point of lowest OI suggests an intense liquidation during a moment of price weakness.

Conclusion

The Bitcoin market is in a phase where deleveraging is a dominant feature. The steady decline in Open Interest, accompanied by the price decline, indicates a significant correction and reduced participation by derivatives traders. The crucial April 9, 2025, data point, with exceptionally high OI trading volume in a context of minimal OI and falling price, could signal a possible final capitulation. While this doesn't guarantee an immediate trend reversal, it has historically marked points where selling pressure begins to exhaust itself, opening the door to technical rebounds. Investors should remain cautious and monitor volume and OI developments in the coming sessions to confirm whether this spike in activity marks a turning point or simply a pause before a larger correction.

Disclaimer: The information provided in this analysis is strictly for informational and educational purposes. It does not constitute financial, investment, legal, tax, or other advice. The cryptocurrency market is highly volatile and speculative, and carries a significant risk of loss of capital. Past performance does not guarantee future results. Any investment decision you make should be based on your own thorough research, independent analysis, and assessment of your risk tolerance.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit