Correlation analysis reveals that Bitcoin continues to act as a risk asset, with its price dangerously synchronized with the Nasdaq and S&P 500 amid inflation fears.

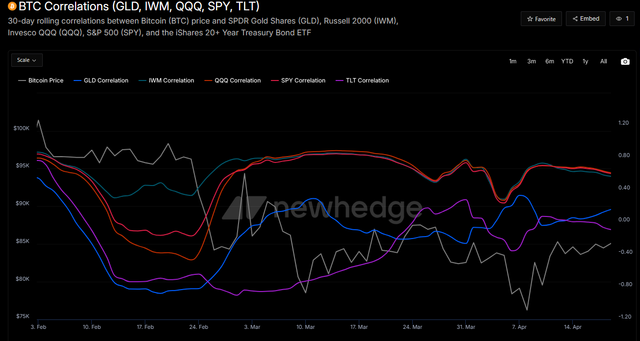

According to data from on-chain analytics firm NewHedge, Bitcoin (BTC), currently trading at $85,073, continues to display a strong correlation with major US stock indices, especially the Nasdaq-100 (QQQ) and the S&P 500 (SPY), with coefficients of 0.62 and 0.61 respectively. This synchronicity, which has intensified since March amid the Trump-led tariff war and fears of persistent inflation, suggests that Bitcoin's fate remains closely tied to risk appetite in traditional markets.

Bitcoin's high correlation with the Nasdaq-100 and S&P 500 underscores investors' perception of the cryptocurrency as a risky asset / NewHedge

Bitcoin and Wall Street: A Dangerous Tango in Uncertain Times

Bitcoin's high correlation with the Nasdaq-100 and S&P 500 underscores investors' perception of the cryptocurrency as a risky asset, sensitive to stock market sentiment, particularly in the technology sector and large-cap stocks. This trend has consolidated in an environment marked by economic uncertainty generated by the possible resurgence of inflation, making it difficult for the Federal Reserve to consider early interest rate cuts.

The correlation with the Russell 2000 (IWM), which groups together small-cap stocks, stands at a significant 0.57, reinforcing the idea that Bitcoin behaves similarly to growth stocks, seeking higher returns but with greater volatility.

The Dream of "Digital Gold" Fades for Now

In contrast, Bitcoin's correlation with gold (GLD) remains low at 0.18, suggesting that the narrative of Bitcoin as "digital gold" or a safe haven during times of economic turbulence is not materializing in the current cycle. Similarly, the negative correlation with long-term Treasuries (TLT), at -0.09, confirms that Bitcoin does not benefit from risk-averse environments, where investors typically seek the safety of fixed income.

Key Insights: The Market in "Risk-On" Mode

Correlation analysis paints a picture where the market is treating Bitcoin primarily as a growth asset, closely tied to the performance of technology stocks. This implies that any significant correction in the Nasdaq could drag Bitcoin down with it, while a continuation of the rally in the technology sector could propel the cryptocurrency to new highs.

The low correlation with gold and bonds indicates that, for the time being, investors are not using Bitcoin as a hedge against inflation or fixed-income volatility. However, a potential increase in the correlation with gold in the future could signal a shift in the narrative toward a "store of value."

Bitcoin remains firmly anchored to the performance of traditional stock markets, especially the technology sector. In the short term, the key to anticipating Bitcoin's price movements will lie in closely monitoring the strength of the Nasdaq and institutional flows. A correction in technology stocks will likely negatively impact Bitcoin, while a robust stock market could continue to drive its price higher. Investors should closely monitor these indicators to navigate the volatility of the cryptocurrency market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency trading is highly volatile and carries significant risks, including the total loss of your invested capital. Consult a financial advisor before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit