Institutional appetite for Bitcoin is soaring to near-all-time highs, fueled by Trump's tariff truce and renewed market optimism.

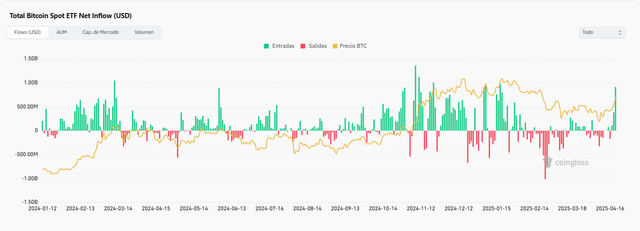

Capital flow into Bitcoin exchange-traded funds (ETFs) experienced an impressive surge this Tuesday, recording a positive net inflow of $912.7 million, according to Coinglass data. This influx of capital, which follows a positive inflow of $381.3 million the day before and $106.9 million at the close of last week, marks a dramatic turnaround after weeks of net outflows, boosting market optimism for the leading cryptocurrency.

The recent capital injection into Bitcoin ETFs is dangerously close to the all-time highs seen on January 17, 2025 / Coinglass

Institutional Appetite for Bitcoin Nears January Highs

The recent injection of capital into Bitcoin ETFs is dangerously close to the all-time highs seen on January 17, 2025, underscoring renewed institutional appetite for the digital asset. Trading volume in these instruments reached $5.74 billion, the highest level since the $6.36 billion traded on March 3. As a result, the total market capitalization of Bitcoin ETFs climbed to $106.42 billion, approaching the peak of March 5, 2025, although still far from the record of $125.15 billion reached on January 26, 2025.

Assets under custody in Bitcoin ETFs are steadily rising

In parallel with the increase in capital flow, digital assets under custody in Bitcoin ETFs also experienced a significant increase, reaching $102.02 billion, approaching the peak recorded on March 25, 2025. This upward trend in assets under management reflects growing confidence among institutional investors in Bitcoin's long-term outlook.

Trump's Tariff Truce Unleashes Demand for Risk Assets

This renewed strength in the Bitcoin ETF market coincides with a strategic move by the United States government in its trade policy with China. President Donald Trump surprised markets by announcing a significant reduction in tariffs on Chinese products, partially reversing the aggressive stance he had maintained in the trade war between the two nations. Trump indicated that the tariffs will be substantially reduced from the current 145%, although they will not reach zero. This announcement revived expectations of a possible easing of trade tensions, boosting demand for risk assets, including cryptocurrencies and Bitcoin given their correlation.

Bitcoin Breaks Through to Key Resistance at $95,000

At the time of this report, the Bitcoin price is struggling with key resistance at $95,000, trading around $93,200. The breakout above the 50- and 200-period moving averages sends a clear signal of bullish sentiment in the market, supported by the massive capital inflow into ETFs. Trump's tariff truce has acted as an additional catalyst, injecting optimism into investors and paving the way for a potential test of the coveted $95,000 mark in the short term.

The impressive capital inflow into Bitcoin ETFs marks a turning point in the market, signaling renewed institutional appetite and growing optimism driven by Trump's tariff truce. With the Bitcoin price challenging the $95,000 resistance, investors will be keen to determine whether this wave of capital has enough strength to fuel a new, sustained bullish phase.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency trading is highly volatile and carries significant risks, including the total loss of all invested capital. Consult a financial advisor before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit