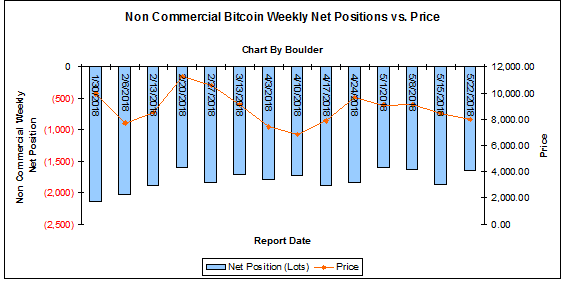

For Bitcoins, the latest COT as of Tuesday, May 22, 2018, institutions stay net short bitcoins and decreased bearish bets by 215 bitcoins to net negative 1,659 bitcoins,

312 longs were closed and 527 shorts were closed as well, Now Longs total 2,840 bitcoins vs shorts total 4,499 bitcoins .

39% long exposure vs 61% short exposure , the same as the previous week

This week Bitcoin started at 8,481 on 5/15, rallied high to 8,590 , came down to 7,951 low on 5/25, closed at 7,984 on 5/22

More longs being closed indicated institutions not expecting price moving higher after hit 9900s last week.They also closed more shorts when price at 7900-8000s levels

Bearish bias remains...

Please note institutions take weeks and months to build a position. Bitcoin future exchange started a few months ago,

there were not enough data to analyze institutions long term view in crypto market.

Some of them decided to get some more popcorn for @gatorinla.🍿

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you @scorer for uv ...are you the one having the popcorn?

I remember you are one of the smart ones who were shorting crypto last week, ..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm still hoping that we are not there yet. 😅

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

7431/7534 may be needed again, b4 a run at 6800 imho

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit