BitcoinBit (BCB), as a new cryptocurrency, claims to be more than just blockchain technology; it has the potential to revolutionize the global financial system. However, to assess this claim, we need to analyze the potential and challenges that BCB faces.

BitcoinBit’s transition to a Proof of Stake (PoS) system represents a key advancement in the blockchain space. Traditional PoW blockchains like Bitcoin rely on miners competing to solve complex mathematical puzzles using high-performance computing, leading to significant power consumption. This model, while secure, is criticized for its negative environmental impact and limited scalability.

In contrast, BitcoinBit’s PoS mechanism addresses these challenges by selecting validators based on their stake in the network rather than their computational power. Validators are incentivized through staking rewards and penalties for malicious activity, ensuring the security and decentralization of the network while drastically reducing energy consumption. This eco-friendly approach supports global Environmental, Social, and Governance (ESG) standards, making BitcoinBit an attractive option for environmentally conscious investors and developers.

BCB’s Potential as a Financial Revolution:

Decentralization: BCB, as a cryptocurrency, offers a decentralized financial system, reducing the control of centralized financial institutions. This can increase transparency, security, and resistance to censorship.

Accessibility: BCB has the potential to provide access to financial services for those who do not have bank accounts or access to traditional financial services. This can empower underserved communities and drive financial inclusion.

Efficiency: BCB can offer faster and cheaper transactions than traditional financial systems. This can increase efficiency and reduce transaction costs, especially for international transactions.

Innovation: BCB may incorporate technological innovations that go beyond the basic functionality of blockchain, such as improved security, scalability, or new features that enhance the user experience. (Specific details about BCB innovations need to be verified from official sources.)

Challenges Faced by BCB:

Volatility: Cryptocurrency prices are highly volatile, and BCB is no exception. This volatility can pose risks to investors and hinder widespread adoption.

Regulation: Government regulation of cryptocurrencies is still evolving and can create uncertainty. Unclear or changing regulations could hinder the growth and adoption of BCB.

Acceptance: Widespread acceptance of BCB by businesses and individuals is critical to its success. Competition with other established cryptocurrencies will be challenging.

Security: The security of the BCB platform is critical to prevent hacking and theft. Adverse security incidents can damage trust and hinder adoption.

How BitcoinBit’s PoS Technology Mimics Ethereum’s Successful Transition

BitcoinBit’s decision to implement PoS technology also refers to the successful implementation seen in Ethereum’s transition from PoW to PoS, known as “The Merge,” which was completed in September 2022. Ethereum’s transition to PoS demonstrated that PoS can be scaled to handle high-volume transactions while significantly reducing energy consumption.

BitcoinBit took inspiration from Ethereum’s transition, ensuring that its PoS architecture was robust and scalable from the start. By avoiding the challenges that Ethereum faced during its transition, such as adjusting block times and ensuring validator coordination, BitcoinBit’s PoS structure has been designed for long-term stability. The main benefits that BitcoinBit gains from adopting Ethereum’s PoS include:

Stable Block Time: BitcoinBit uses a fixed block time of 5 seconds, ensuring consistent and predictable transaction finality, unlike PoW systems which can have varying block intervals.

Separation of Consensus and Execution Layers: BitcoinBit has adopted a similar separation between consensus and execution layers as Ethereum post-Merge, improving scalability and allowing for smoother network upgrades.

No Technical Debt: Because the BitcoinBit network was designed to use PoS from the start, it avoids the technical debt associated with Ethereum’s late-stage PoS adoption, allowing for better long-term performance.

How BitcoinBit’s Tokenomics Create a Sustainable Blockchain Ecosystem

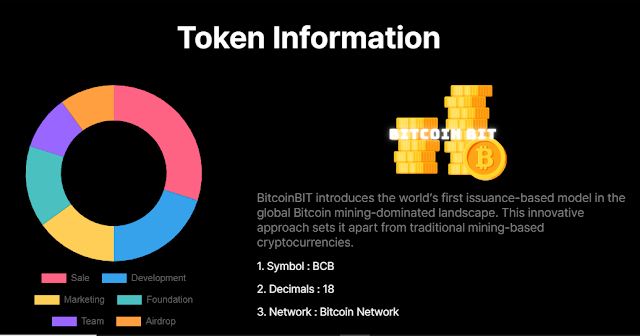

BitcoinBit's native token, BCB, is central to its ecosystem and serves multiple functions, including staking, governance, and transaction fees. The total supply of BCB is capped at 21 million, ensuring that the token remains scarce and not subject to inflation. This fixed supply mirrors Bitcoin’s structure, which adds a layer of value preservation.

The BCB token is distributed across various sectors of the ecosystem, including 50% for community distribution, 30% for liquidity and partnerships, 10% for development, and 10% reserved for future growth. This distribution model ensures that the network remains decentralized while also incentivizing long-term engagement through staking rewards and governance participation.

How BitcoinBit’s Staking Mechanism Drives Engagement and Network Security

One of the key features of BitcoinBit is its staking mechanism. To participate as a validator in the network, individuals must stake a minimum amount of BCB tokens, ensuring that only those with a vested interest in the network's success can participate in block creation. This method promotes security by disincentivizing malicious activities. Validators are rewarded for their efforts with transaction fees and block rewards, which not only encourages long-term participation but also strengthens the overall network.

Validators are also subject to slashing penalties if they engage in dishonest behavior, such as double-signing or remaining offline for extended periods. This system further ensures the integrity of the network and discourages centralization of power, as validators must maintain a high standard of operation to remain profitable.

Conclusion:

BitcoinBit (BCB) has the potential to be more than just blockchain technology; it can revolutionize the financial system by offering decentralization, accessibility, and efficiency. However, significant challenges related to volatility, regulation, acceptance, and security need to be overcome for BCB to reach its full potential and truly revolutionize the global financial system.

for more information:

Website: https://www.bitcoinbit.xyz/

Twitter: https://x.com/bitcoinbit_

Telegram: https://t.me/BitCoinBit_BCB

Authored by

Forum Username: Betecegold

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=2516721

Telegram username: @Betecegold

BSC Wallet Address: 0xdF2Bf2D2E832dE97687Cc0A222bbaDbD9212C6fB

god bless you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit