Investors on Pause! The Crypto Fear and Greed Index Signals Neutrality as Key Economic Data Threatens to Unleash Volatility

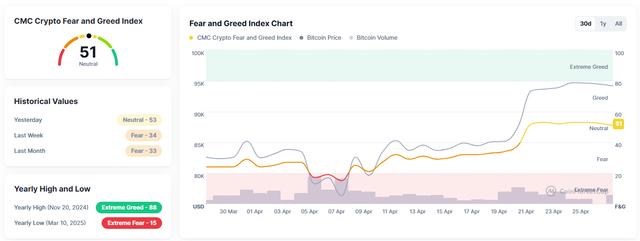

The cryptocurrency market is in an intriguing phase of equilibrium, according to the CMC Crypto Fear and Greed Index, which currently stands at 51 points, marking a neutral zone. This reading suggests an absence of extreme emotions, where neither paralyzing fear nor unbridled greed dominates investor decisions. However, this calm could be the prelude to a turbulent week, marked by the release of a series of crucial economic data that could shake the market to its foundations.

The cryptocurrency marketThe CMC Crypto Fear and Greed Index is apparently calm, with the CMC Crypto Fear and Greed Index marking a neutral 51 points. / CMC

What Does Neutrality Mean in Crypto Sentiment?

An index at 51 points implies that overall market sentiment is neither strongly inclined toward unbridled optimism nor absolute pessimism. Investors appear to be in a wait-and-see mode, with neither the urge to panic sell nor the overwhelming need to buy for fear of missing out on potential gains. This hesitancy could be a reflection of macroeconomic uncertainty and the expectation of future events that could tip the balance.

Key Week: Economic Data in Focus

The current relative calm could be short-lived. This week, a flood of key economic data is expected that could offer crucial clues about the impact of tariff policies and the overall health of the economy. Among the most relevant indicators are the JOLTs Job Openings, ADP Employment Change, Non-Farm Payrolls, and the Unemployment Rate. Additionally, data on Consumer Confidence (CB), the QoQ GDP Growth Rate, the Core PCE Price Index (MoM), Personal Income (MoM), Personal Spending (MoM), and the ISM Manufacturing PMI will be released.

Traders and investors will be particularly attentive to these figures, as they could significantly influence the Federal Reserve's (Fed) decisions. The release of this data will allow them to assess the initial impact of the tariffs implemented by the Donald Trump administration and determine whether the Fed might consider future interest rate cuts or maintain its current restrictive policy. A surprise in any of these indicators could inject strong volatility into financial markets, including cryptocurrencies.

Implications for Trading in a Neutral Market

The current market neutrality presents a particular scenario for traders:

Indecision and Waiting: The lack of dominant sentiment can translate into a period of consolidation or sideways price movements. Traders may opt for caution, waiting for a clearer direction before deploying significant capital.

Crucial Technical Analysis: In the absence of a strong emotional bias, technical analysis becomes more relevant. Identifying key support and resistance levels, as well as observing chart patterns, could offer clues to potential breakouts and future movements.

Latent Volatility: Although current volatility may be moderate, the proximity of important economic data releases suggests a potential increase in volatility towards the end of the week. Traders should be prepared for sharp market reactions.

Beyond Sentiment: The Macroeconomic Context

It is essential to remember that the CMC Crypto Fear and Greed Index is only one piece of the puzzle. Market sentiment can be influenced by a wide range of factors, including regulatory news, technological advancements in the blockchain space, and, crucially at this time, macroeconomic data and central bank policies. Therefore, a neutral reading should not be interpreted as a definitive signal, but rather as a snapshot of the market's emotional state at a given moment.

In conclusion, the cryptocurrency market is seemingly calm, with the CMC Crypto Fear and Greed Index marking a neutral 51 points. However, this reassurance could be the calm before the storm, as a battery of key economic data is looming, with the potential to influence the Federal Reserve's decisions and unleash a new wave of volatility. Investors and traders will need to remain vigilant and combine sentiment analysis with a thorough assessment of the technical and fundamental landscape to navigate the potential turbulence ahead.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Cryptocurrency trading is highly volatile and carries significant risks of capital loss. Please conduct your own research before making any investment decisions.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit