On February 20th, the price of Ethereum rose to a new high of US$ 2,015. One of the main driving factors of the current bullish sentiment is the launch of CME Ethereum Futures

Amazon Web Services(AWS) announced yesterday that Ethereum can be fully used on its hosting service Amazon Managed Blockchain, which promotes the further price increase of Ethereum.

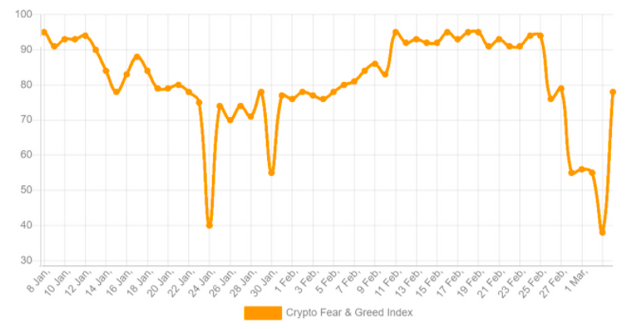

At present, the crypto fear and greed index is 93, which indicates "extreme greed" according to its calculation method. Many traders use this indicator as a reverse trading signal, which means that the extreme level of fear may indicate that investors are bullish and have buying opportunities. On the contrary, when investors become too greedy, it may indicate that the market is about to pull back.

During the period from February 19th to February 23rd, long futures contracts of USD 2 billion were liquidated, accounting for 28% of the total open contracts. As described by previous indicators of fear and greed, people should expect the market sentiment to deteriorate significantly.

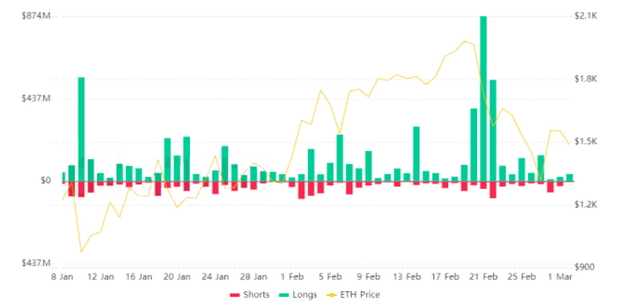

By measuring the cost difference between futures and conventional spot market, traders can measure the bullish level of the market.

Compared with conventional spot trading, three-month futures should usually be traded at a premium of 10% or higher. Whenever the indicator fades or turns negative, it is a red flag that is alarming. This situation is called spot premium, which indicates that the market is turning bearish.

The above figure shows that as Ethereum hit a record high, the index reached a peak of 39% on February 20th. However, throughout the callback process, it has remained above 16%. This data shows that professional traders are still full of confidence in the price potential of Ethereum.

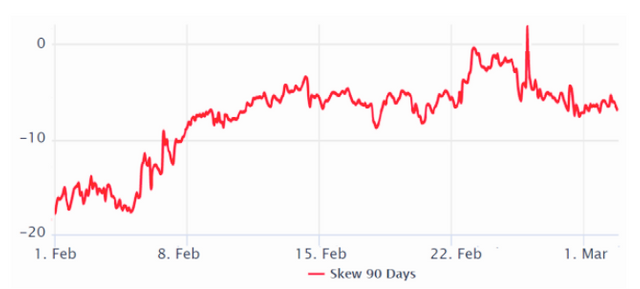

When analyzing options, 25% incremental deviation is the most relevant index. This indicator compares similar call (buy) and put (sell) options side by side.

When put option premium is higher than call option with similar risk, it will turn negative. Negative value means higher down protection cost and indicates bullish value.

The futures and options indicators discussed above kept bullish during the economic downturn, which is very encouraging.

However, a key market indicator shows that there are some potential risks in the price trend of Ethereum.

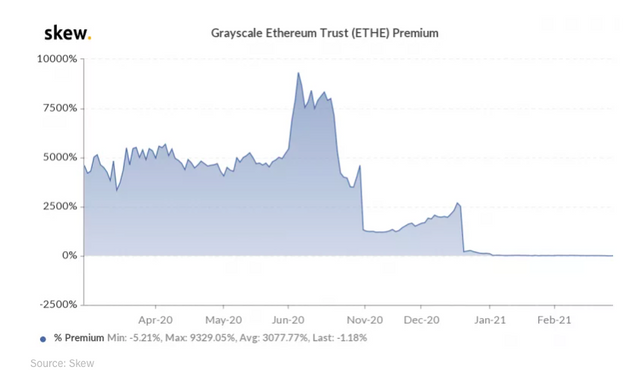

According to Skew's data, the premium of Gray Ethereum Trust turned negative last week, which means that the trading price of the trust is lower than the spot price, which is the first time in the history of the trust that it closed negative.

Image source: Skew, laevitas.ch, Bybt.com, alternative.me, pixabay

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit