Hi folks, how are you? this is your very Faran Nabeel. I hope all my fellows will be happy and all are doing well. now this is third week of engagment challenge and i am here in steemit crypyo academy for participating in this week challenge. As in the dynamic world of crypto currency, many opportunities emerge with the time.

Liquid staking unlock the potential to earn the rewards on staking assets while preserve the liquidity. This method transform staking with flexibility and quick access to funds.

Tokenizing real-world assets bridge the gap between investment and digital finance. Investor can participate in diverse asset class, from real estate to commodities in the technology, through blockchain tokens, diversify portfolios and enhance the liquidity. This development empower user to capitalize on multiple revenue in the decentralize ecosystem.

Question 1: Understanding Liquid Staking

Liquid staking solve the big problem with regular staking like locked up the coins. In the traditional staking, you deposit the crypto like ETH to help secure the blockchain and earn rewards from staking, but the problem is that your coins are frozen and you cannot trade or use them for other purpose. Liquid staking fix this problem by giving you the token represent your stake coins.

How it works:

- Platforms like Lido Finance let us stake ETH and get stETH tokens in return form.

- Rocket Pool does the same but issue with rETH.

- This tokens track your stake coins and rewards. You can use it in DeFi for example lending, while still earn the staking rewards.

Advantages:

- Liquidity: We can use stETH/rETH in DeFi app instead of idle coins for earn more rewards.

- Easy access: No technical setup need like Lido handle node operations.

- Decentralization: Rocket Pool let anyone run nodes with just 16 ETH.

Risks:

- Smart contract bugs: Hackers could exploit the weak point such as past issues in DeFi.

- Centralization: Lido rely on the few numbers of node operators. if they show misbehave, funds can be at the risk.

- Depegging: stSOL can lost its 1:1 SOL value during market crashes like Terra luna collapse because of panic.

At the end, liquid staking through Lido, Rocket Pool and Frax offer flexibility but is not risk free. It is great for earn the rewards and stay active in DeFi.

Question 2: Opportunities in Real-World Asset Tokenization

Tokenize the real-world asset (RWA) like real estate, stocks, and gold mean turn them into digital tokens on the blockchain. This all bridges traditional finance with DeFi apps, unlock the new opportunities. Platforms like the Chainlink (LINK), Hedera (HBAR), and Avalanche (AVAX) are leaders of this shift.

How It Works:

Chainlink (LINK): Act as a “data bridge.” Its oracle securely connect the off-chain real world asset data for example gold price, property record to blockchain. For example, a gold back token use the chainlink to verify real time gold price, and ensure the transparency.

Hedera (HBAR): It is use fast and low cost hashgraph technology to tokenize asset like carbon credit. Different companies like DOVU tokenize the carbon offset on Hedera, make them tradable in DeFi

Avalanche (AVAX): it's offer customizable blockchain or “subnets” for institutions in that time. For instance, Securitize is the company which use the Avalanche to tokenize the private equity, let give smaller investors to buy the fractional shares.

Benefits:

Liquidity: Tokenizie the lliquid assets like real estate let them to trade 24/7 on DeFi platforms.

Accessibility: Fractional ownership such as owning 0.1 percent of the skyscraper that allows the investing to everyone.

Transparency: Records in the blockchain prove the ownership and audit trail, and reducing the fraud ratio.

Challenges:

- Regulations: Laws globally tokenize the building in the U.S. create clash with EU rule.

- Trust: Token must be back by real assets with the solid record. If the gold token vault is not audited, it’s worthless in real time.

- Technology Limits: Hedera and Avalanche services are scalable, but older blockchain struggle with the RWA data volume.

Risks:

- Oracle failure: If Chainlink provide the wrong data, token value can crash.

- Centralization: Some RWA projects depend on centralized issuer such as bank controll the tokenize bonds.

In the world of RWA, tokenization that powered by LINK, HBAR, AVAX blockchain is make DeFi more practical and inclusive. Balancing the innovation with regulations and trust remain key to its success.

Question 3: Practical Applications of Liquid Staking in DeFi

Liquid staking tokens like stETH on Lido provide to users to earn staking rewards and use that tokens in DeFi to boost return. Here is the common strategy:

Example: stETH Collateral with Borrowing

1). Stake ETH on Lido: Stake your ETH and other token and get stETH and you can earn 3 to 5% annual staking rewards.

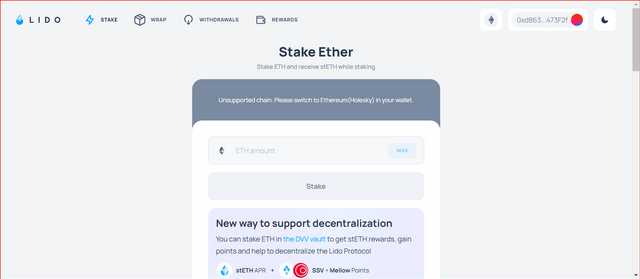

This is the testnet of Lido, and user can stake Eth and get stETH in return in the wallet and user can use on other platform like Aave to borrow the stablecoin.

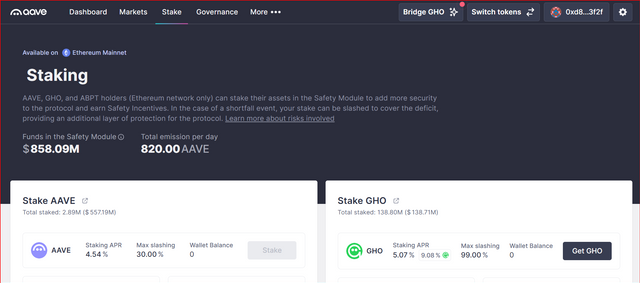

2). Deposit stETH on Aave: Use it as the collateral to borrow stablecoin such as USDC and USDT.

After stake your ETH on Lido, we can get stEth and then deposit into aave to get stablecoin as a collecteral like USDC.

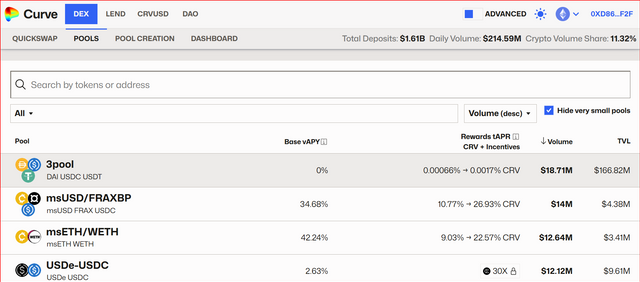

3). Farm with USDC and USDT: Deposit borrow USDC and other stable coin into the yield farm like Curve pool for extra 5 to 10%.

Deposit the borrow stable coin into farming pool such as curve finance for extra passive income.

4). Repeat: Use this rewards to repay debt and compound earning.

In this way, we can earn staking rewards, borrowing fees, farming yields and amplifying profits.

Benefits:

- Liquidity multiplier: We can use stETH and rETH instead of idle ETH.

- Dual earning: Earn passive staking and active DeFi gains.

Risks:

- Liquidation: If price of ETH crash, your stETH collateral value will absolutely drop. and Aave might sell your fund cheaply to cover the debt.

- Smart contract bugs: Aave, Lido, and Curve can have multiple vulnerabilities like hacks and other attacks.

- Depegging: If stETH lose its 1:1 ETH peg during market panic condition, your collateral become discounted, raise the liquidation risk.

- Interest rates: The cost of borrowing can spike, and convert into profits.

Liquid staking token unlock DeFi strategy that stack reward, but risk like crash and technical flaw require caution. Always asses risk before over leveraging.

Question 4: Building a DeFi Strategy with Liquid Staking and RWAs

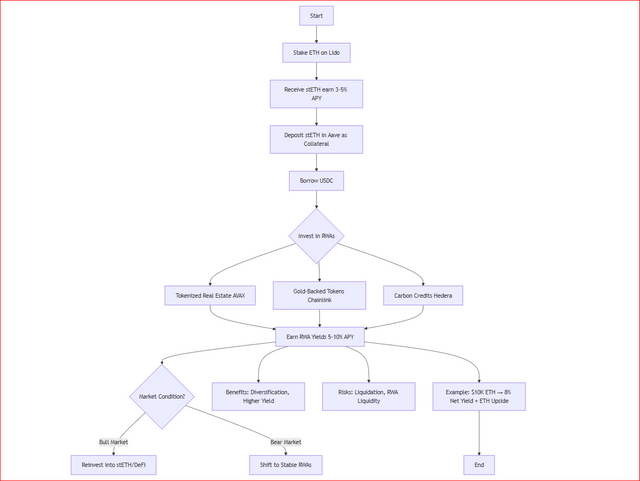

This strategy blend the liquid staking rewards with real-world asset diversificate to maximize yield and reduce risks. There are few steps to earn with combine strategy.

Step 1: Liquid Staking

Stake ETH on Lido to get the stETH and earn staking rewards. Keep stETH liquid to use in the DeFi.

Step 2: Borrow Against the stETH

Deposit your stETH into the Aave which is a lending platform as work for collateral. Borrow the stablecoin against it as i discussed previous. This avoid the selling ETH and keep the staking rewards active.

Step 3: Invest in Tokenize RWAs

Use borrowed stablecoin to buy RWA tokens like Avalanche, ONDO, and other market players which provide the real world asset. buy gold back token using chainlink which work for price accuracy. Carbon credits such as on Hedera for lower fee and fast transactions. Earn yield from real world assets dividends, rent, and trading.

Step 4: Reinvest or Hedge

Use RWA profit to repay borrow fee and compound earning. In the crypto downtrend, shift more stablecoin into RWA for stability. In the bull run market, focus on stETH and DeFi yields.

Benefits:

Higher Yield: Stack staking rewards, RWA return, and borrowing leverage.

Diversification: Balance volatilty crypto with stable real world assets like real estate.

Flexibility: Adapt allocationsbase on market trend.

Risks:

Liquidation: If ETH crash it, stETH collateral lose its value, force to Aave to sell it in cheap prices.

RWA Liquidity: Tokenize asset can be hard to sell quickly.

Oracle Failures: Incorrect pricing for example chainlink glitch can distort RWAs values.

Example:

You Stake $8K ETH → get $10k value base stETH → and borrow $5K USDC or other stablecoin → invest in Avalanche base tokenize apartment. Earn approximately 4% from staking and 7% from rental, minus the 3% borrowing fee is equal to 8% net yield, and plus the upside from ETH price growth as market in green phase.

Question 5: Lessons from Real-Life DeFi Innovations

Approaxemately in 2023, a trader craft the DeFi strategy combine both liquid staking and RWA tokenization to maximize return. She start by staking 50 ETH on Lido, and receive stETH token while earn 4% annual staking reward. Instead of let her ETH sit in locked, she used stETH as the collateral on the Aave to borrow $40,000 in stablecoin like USDC. With this fund, she diversify into tokenized real-world assets. Real estate token on the Avalanche subnet, offer the 7% rental yield. Another one carbon credit tokens on the Hedera, which is surge in value with the passage time. Third, gold back token through Chainlink oracles, act as athe stable hedge.

After few months, this strategy work. The price of ETH rose by 30%, boost her stETH collateral values. The real estate token pay the steady yields, and carbon credit gain which is 15% as climate regulations tighten. Maya portfolio grow to $180,000 which a mix of crypto growth and RWA income.

The Crisis:

In the early 2024, A major bug found in the Chainlink oracle price the gold token, become cause their value to drop 40% overnight. Panic spread everywhere and Aave automatically liquidate part of Maya’s stETH collateral to cover her stable loan, sell her ETH at the market low. Also her carbon credit token on the Hedera became untradable due to the liquidity issue, freeze $20,000 of her fund. The price of ETH also drop 25%, compound loss.

The After-math:

The portfolio of her drop to $90,000. While on the other side her real estate token held the value, she cannot access cash quickly to avoid losses. The glitch of Chainlink was later fix, but the damage was also done.

Key Points for Investors**:

- Diversify, But also Verify: RWA add stability, but also check their back. Chainlink oracle bug show that even “secure” system can fail. Audit the RWA project like gold vault, before investing.

- Beware of Over-Leverage: It is the basic rule in crypto, Borrow 40% against crypto can seem safe, but sudden crashe and tech failure can trigger quick liquidation. Use normal loan tovalue ratios.

- Prioritize Liquidity: Tokenize real estate and carbon credit can offer high yield but can not be sold fast in the crisis. Balance in RWAs with liquid assets such as stablecoins, and blue-chip tokens.

- Stay Adaptable: Maya could shift her funds to stable RWAs for tokenize bonds during the gold token crisis. Flexibility is the key in volatile market.

- Insurance Matters: Platform like a Nexus Mutual offers smart contract coverages. A small fee coul have protect Maya from the Chainlink exploit and flaws.

Now I am inviting my friends @suboohi, @chant, @ashkhan, @josepha, @abdullahw2 and @artist1111 to participate in this contest. Thank you so much for your kind support.

Regards,

Faran Nabeel

Cc : @kouba01

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit