Hello everyone i hope you all are good and enjoy your life. In Week 3 of Season 23 of the Steemit Learning Challenge I will explore two of the latest innovations in DeFi Liquid Staking and Realworld Asset (RWA) Tokenization. These two concepts are changing the way people use DeFi by improving liquidity and making traditional investments available in the blockchain.

Question 1: Understanding Liquid Staking |

|---|

In the world of cryptocurrency staking is way to earn rewards by locking up tokens to support blockchain net work. However traditional staking have a big problem: once tokens are stake they are locked and cannot be used until the staking period end. This means if a great investments opportunity comes up I can not use my staked token until they is unlock.

What is Liquid Staking?

Liquid staking solves this problem by allowing me to stake my tokens and still use them at the same time. Whenever I stake my tokens with liquid staking platform I received special stake tokens in return. This staked token represent my staked asset and can be use for trading lending or provide liquidity in DeFi while I continue earning staking rewards .

.png)

How Liquid Staking Differs from Traditional Staking

| Feature | Traditional Staking | Liquid Staking |

|---|---|---|

| Liquidity | Tokens are locked and cannot be used. | Token remain usable through staked tokens. |

| Flexibility | Staked tokens cannot be traded or use else where. | Staked tokens can be traded or used in DeFi. |

| Risk Management | Staker must wait for the unlock period to sell or move fund. | Staked tokens can be sold any time to access fund |

Advantages of Liquid Staking

- Liquidity I can earn staking rewards without losing access to my fund. If I ever need to sell or trade I can use my liquid staked tokens.

- More Earning Opportunities Instead of just staking and waiting I can use my liquid staked token in DeFi platforms to earn extra income. For example I can provides liquidity in a DeFi pool or use my token as collateral for loan.

- No Lock-Up Period unlike traditional staking where my funds are locked liquid staking give me the freedom to sell anytime if I needed my money.

Risks of Liquid Staking

- Smart Contract Risks Since liquid staking depend on smart contract there is alway a risk of bugs or hacking. If the platform I use get exploited I could lose my funds.

- Price Volatility of Staked Tokens The liquid staking tokens (like stETH rETH or sfrxETH) might not always match the value of the originals asset. Some times due to market conditions they trade at a lower price.

- Platform Dependency Liquid staking platforms are not Controlled by the blockchain itself. If platform faces technical or financial issues it could affect my stake asset.

Examples of Liquid Staking Platforms

- Lido (stETH) The most popular liquid staking platform where users stake Ethereum and receive stETH (staked ETH) in return. This stETH can be traded or used in DeFi.

- Rocket Pool (rETH) A decentralized staking platform where users can stake as little as 0.01 ETH and receive rETH (Rocket ETH) while helping to secure the network.

- Frax (sfrxETH) Frax offers an innovative staking solution where user get sfrxETH liquid staking token that help maximize staking rewards.

Question 2: Opportunities in Real-World Asset Tokenization |

|---|

Opportunities in Real-World Asset Tokenization

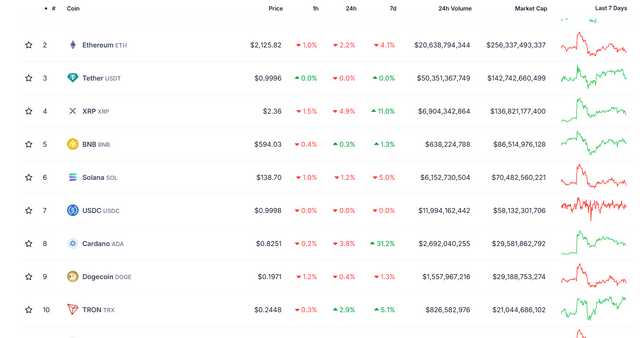

Decentralized Finance (DeFi) is evolving rapidly and Real World Asset (RWA) tokenization is one of its biggests innovations. It bridges the gap between traditional finance and blockchain technology by allowing physical asset Such as real estate gold stocks bonds and commodities to be represent as digital tokens on the blockchain.

By tokenizing real world assets DeFi becomes more accessible liquid and Efficient allowing people to invest in asset that were previously difficult to trades.

How RWA Tokenization is Changing DeFi

In traditional finance buying and selling real-world assets can be slow expensive and difficult due to paperwork legal restrictions and high entry cost. Tokenization solve these problems by turning assets into digital token that can be easily traded on blockchain based platform.

For example:

- Instead of buying an entire property I could buy a fraction of it as a token.

- Instead of physically holding gold I could own gold-backed tokens.

- Instead of waiting days to trade stocks I could instantly trade stock backed tokens on a DeFi Platform.

This unlock new investment opportunities improve liquidity and allows global access to asset that were previously out of reach.

Examples of Platforms Enabling RWA Tokenization

Several DeFi platforms are leading the way in RWA tokenization:

- Goldfinch (https://goldfinch.finance/) – Focuses on credit-based lending by tokenizing loan and realnworld debt.

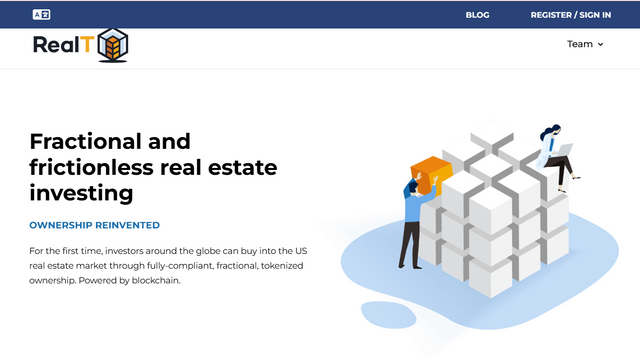

- RealT (https://realt.co/) – Allows users to buy fractional ownership of real estate using blockchain based tokens.

.png)

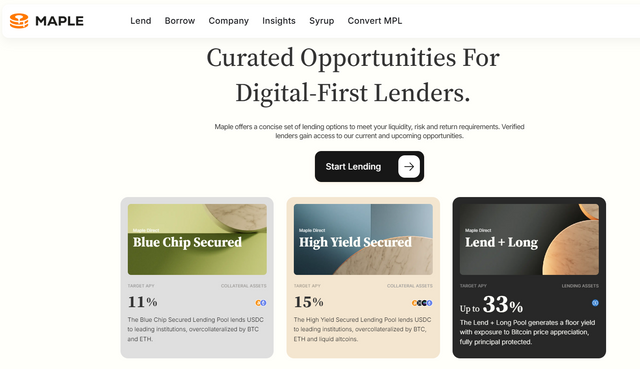

- Maple Finance (https://maple.finance/) – Provides on-chain lending services backed by tokenized real-world assets.

- Centrifuge (https://centrifuge.io/) – Converts real-world invoices and financial asset into blockchain tokens for easy liquidity.

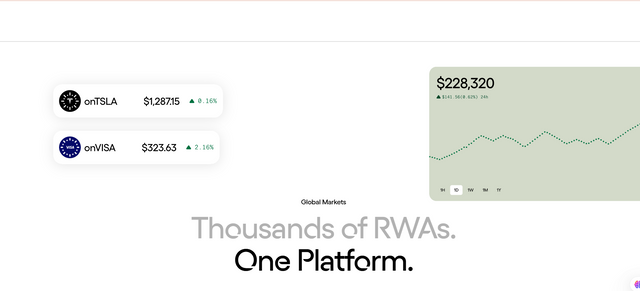

- Ondo Finance (https://ondo.finance/) – Tokenizes U.S. Treasury bonds giving Crypto investors access to stable real-world investments.

.png)

Benefits of RWA Tokenization in DeFi

Increased Liquidity – Tokenized assets can be easily traded 24/7 on DeFi platforms Unlike traditional assets that have long processing times.

Fractional Ownership – Investors don’t need millions to buy real estate gold or bond. Instead they can own a small portion of these asset through tokenization.

Global Accessibility – Anyone anywhere in the world can invest in tokenized asset without geographic restriction or needing a bank account.

Transparency and Security – Blockchain ensures that ownership records are secure and transaction are fully transparent.

Lower Costs & Faster Transactions – Traditional finance involves middle men (banks brokers legal firms) which increase costs and slow down transactions. With DeFi tokenization transactions are faster and cheaper because they are peer to-peer.

Challenges of RWA Tokenization in DeFi

Regulatory Uncertainty – Many governments do not have clear rules for tokenized real-world assets which could limit adoption or cause legal problems.

Price Volatility – Some tokenized assets may not always match their real-world value due to market fluctuations and low demand.

Security Risks – Smart contract bugs or hacking could put tokenized assets at risk just like other DeFi applications.

Trust Issues – Since real-world assets exist outside of blockchain there is a risk that the company backing the tokens fails to manage them properly. Investors need to trust that assets are truly backed by what they claim.

Real Life Example

Imagine I want to invest in real estate but I don not have enough money to buy a whole property. With tokenization:

- A company tokenizes a $1 000 000 apartment into 1 000 000 tokens each worth $1.

- I can buy 1 000 tokens ($1 000 worth) meaning I own a fraction of the apartment.

- As the property generates rental income I receive my share of the profits base on the number of tokens I own.

- If the apartments value increase the token price also increases and I can sell my tokens for profit

Question 3: Practical Applications of Liquid Staking in DeFi |

|---|

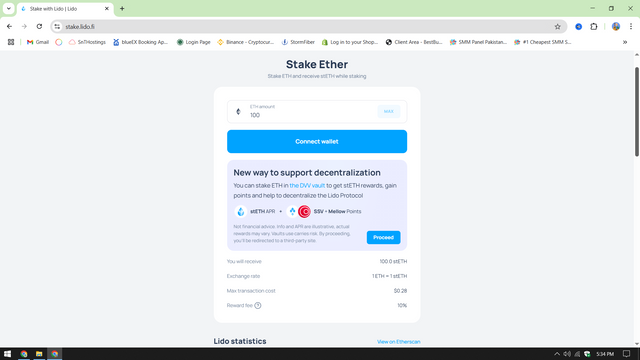

When I stake cryptocurrency (e.g. Ethereum) using liquid staking Platform I received liquid staked tokens in return. This token represented my stake ETH plus the rewards it is generating. For example

- If I stake 1 ETH on Lido Finance I will receive 1 stETH.

- This stETH continuously earn staking reward but I can still used it in DeFi to earn extra profit.

This means I am earning rewards in two ways:

- Staking reward from Ethereum Proof of Stake (PoS) network.

- Extra yield by using stETH in DeFi protocol.

Example Strategy Using Liquid Stake Tokens in Yield Farming

One of the most common way to use liquid staked token is in yield farming where I can deposit them into liquidity pool or lending protocol to earn additional reward

Step-by-Step Strategy Using stETH

Let say I have 10 ETH and I want to maximize my earnings

- Stake ETH on Lido Finance → I stake 10 ETH and received 10 stETH in return.

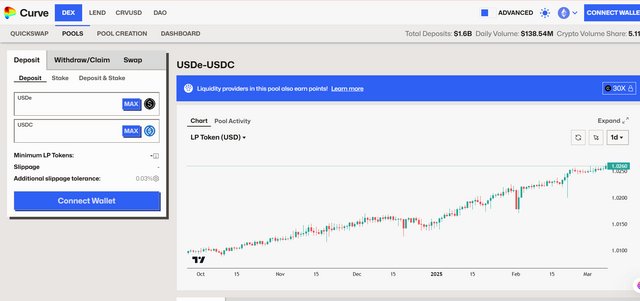

- Provide Liquidity on Curve Finance → I deposit my 10 stETH + 10 ETH into the stETH/ETH liquidity pool on Curve Finance.

- Earn Trading Fees & CRV Reward → I receive a share of the trading fee generate by the liquidity pool plus extra CRV token as a reward.

- Stake CRV Rewards on Convex Finance → Instead of selling my CRV tokens I stake them on Convex Finance for additionals yield.

- Borrow Stablecoins Against stETH → I deposit my stETH as collateral on Aave or MakerDAO and borrow stable coin like USDC or DAI.

- Reinvest the Borrowed Fund → I use the borrowed stablecoin to either buy more ETH and repeats the process or invest in high yield DeFi strategies.

This strategy allows me to

Earn staking rewards from Ethereum.

Earn liquidity provider (LP) fee on Curve Finance.

Earn additional CRV token rewards.

Use stETH as collateral to borrow stable coin for further investment.

By stacking multiple yield sources I am maximizing my profits without losing access to my original ETH investment.

Potential Risks of Liquid Staking Strategies

While this strategy increases potential profits it also come with risks:

Smart Contract Risks → DeFi platforms use smart contracts which could be hacked or exploited leading to loss of funds.

Liquidity Risk → stETH is not the same as ETH. If there is low demand for stETH I might not be able to easily swap it back to ETH.

Price Depeg Risk → The value of stETH might fall below ETH due to market conditions which could lead to liquidation risk in lending protocols.

Liquidation Risk → If I borrow stablecoins against stETH and the price drop my collateral may be liquidate meaning I lose my staked tokens.

Interest Rate Volatility → Borrowing stablecoins against stETH come with variable interest rates which could increase over time and reduce my profit.

Question 4: Building a DeFi Strategy with Liquid Staking and RWAs |

|---|

Building a DeFi Strategy with Liquid Staking and RWAs

In this investment strategy I will integrate liquid staking and realworld asset (RWA) tokenization to optimized yield reduce risk and adapt to different market condition. This strategy focus on earning passive income while maintaining liquidity and diversifying investment across both crypto natived and real world asset.

Step 1: Stake ETH and Receive Liquid Staking Token (stETH/rETH)

Why?

- Traditional staking lock up asset but liquid staking allowed me to keep our fund liquid while earning staking rewards.

- I can used my stake ETH derivative (stETH or rETH) in DeFi protocul.

How?

- I will stake ETH in Lido Finance (https://stake.lido.fi/)

- In return I will received stETH or rETH (liquid staking tokens).

- These tokens will continue earning staking reward while remaining usable in DeFi.

Example: If I staked 10 ETH on Lido I will received 10 stETH. These stETH token will Earn staking rewards (~4-5% APY).

Step 2: Use stETH in DeFi for Additional Yield

Why?

- Instead of just holding stETH I will put it to work in DeFi protocol to earn Extra rewards.

.png)

How?

- Deposit stETH into Curve Finance (https://curve.fi/) to provides liquidity in the stETH/ETH pool.

- This earns me trading fee and CRV token rewards.

- I will then stake my CRV tokens on Convex Finance (https://www.convexfinance.com/) for additional rewards.

Example: If I deposit 10 stETH Into Curve stETH/ETH pool I can earn trading fees + CRV incentives (~5-10% APY).

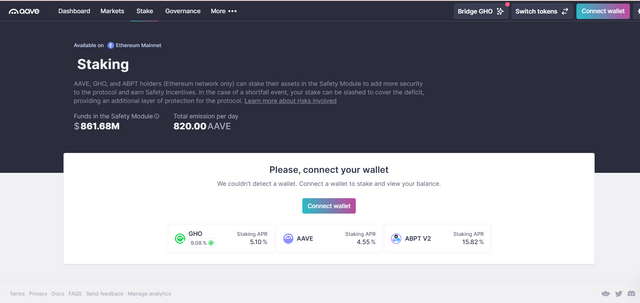

Step 3: Borrow Stablecoins Against stETH on Aave

Why?

- Borrowing stablecoins allows me to unlock liquidity Without selling my staked asset.

- I can reinvest the borrow fund into real world asset (RWAs) for diversification.

How?

- Deposit stETH collateral on Aave (https://app.aave.com/).

- Borrow stablecoins (DAI USDC or USDT) againsts my stETH.

- Used the borowed fund to invest in RWA tokenization platform.

Example: If I deposit 10 stETH on Aave I can borrow 5000 USDC (assuming 50% Loan to Value ratio).

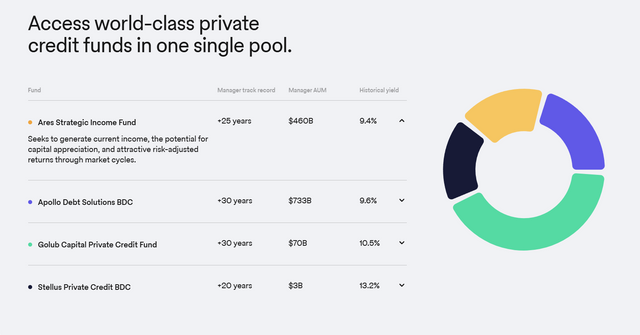

Step 4: Invest Borrowed Stablecoins in RWA Tokenization

Why?

- RWAs provide a stable real world income stream that is less volatile than crypto.

- This strategy balances high yield DeFi with real worlds investments.

How?

- Invest borrowed stablecoins in RWA tokenization platforms such as:

- RealT (https://realt.co/) Invest in tokenized rental properties.

- Maple Finance (https://maple.finance/) Lend to real world businesses.

- Goldfinch (https://goldfinch.finance/) Provide decentralized credit to emerging markets.

- Earn passive income from rental yields interest or loan repayments.

Example: If I invest 5000 USDC in RealT I could earn 8-12% rental yield from tokenize real estate.

Step 5: Reinvest Profits or Repay Loan

Why?

- Profits from RWAs and DeFi yield farming can be used to repay my loan or compound my investment.

How?

- Use RWA income and Curve/Convex rewards to:

- Repay borrowed stablecoins on Aave (to reduce risk).

- Reinvest profits into more liquid staking and RWA assets.

Example: If my total returns from RWAs & DeFi yield reach 15-20% APY I can repay my Aave loan and continued compounding my investment.

Risk Management

- Liquidation Risk:

- If the ETH price droping my Aave collateral (stETH) wil be liquidated.

- solution Maintain safe collateral ratio (LTV below 50%).

- DeFi Protocol Risk:

- smart contract bugs or hacked could lead to loss.

- solution: Use audited and reputable platform (Lido Aave Curve).

- RWA Platform Risk:

- If the RWA issuer default my investment may be at Risk.

- solution Diversify across Multiple RWA platforms.

Question 5: Lessons from Real-Life DeFi Innovations |

|---|

The integration of liquid staking and real world asset (RWA) tokenization into decentralize finance (DeFi) has significantly influence investor outcome . Let me explore a reallife scenario Where RWA integration impacte investor success along with key takeaways for future investor.

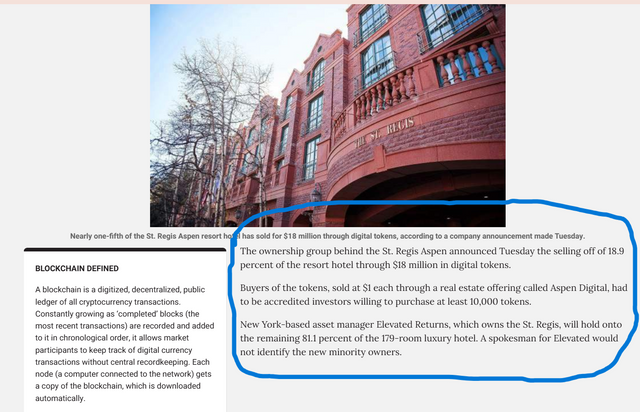

Real Life Success Story: Tokenization of the St. Regis Aspen Resort

In 2018 the St. Regis Aspen Resort a luxury hotel in Colorado underwent tokenization allowing investor to purchase digital token representing fractional ownership of the property. This initiative enable individual to invest in high end real estate without the need for substantial capital. Investor benefite from potentials Property appreciation and received dividend from the hotel revenue all facilitate through block chain technology.

Key Takeaways for Future Investors:

Accessibility: RWA tokenization democratized access to investment opportunitie allowing individuals with varying capital level to participate in asset classes like real Estate.

Liquidity Consideration while tokenization can enhance liquidity the secondary markets for such token may still be developing potentially affacting the ease of buy or selling these asset.

Due Diligence: Investor should thoroughly assess the credibility of the platform offering tokenize asset & understand the underly asset value and associate risk.

Regulatory Landscape: The evolving nature of regulation surounding tokenize asset necessitate staying inform about legal considerationsto ensure compliance and protected investment.

So that was my assignment. It took 3 days to complete, but Allhumdilah, finally, I completed this task. I hope you people will learn something new from this. If you have any questions, ask me.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)