Greetings dear Prof @fredquantum,

It is my pleasure to learn under your tutelage this season 5 week 4 lectures about Trading crypto with On-Balance Volume indicator. Having gone through the lecture notes given, I hereby present my entry before you in confidence of your esteemed perusal.

In your own words, explain your understanding of On-Balance Volume (OBV) Indicator.

Among the many technical indicators available for traders to monitor the movement of asset's price in the market is On-Balance Volume (OBV). This indicator was designed in 1963 by Joseph Granvile for stock market traders. As the name implies, On-Balance Volume (OBV) focuses on the volume of an asset plugged in the market at a given period of time as a determinant factor to price movement either bullish or bearish. With this indicator, a trader can predict which way an asset price will be going in the nearest future by checking its volume of purchase in a particular time. If there is a higher amount of purchase then there will be a smack increase in price of the asset because there are so many buyers, the asset will become scarce. Conversely, a drop in the asset volume is an indication of price fall because there are too many sellers than buyers of such asset in the market. OBV works the same as in the principles affecting the asset's demand and its supply which states that

the higher the demand, the higher the price. The higher the supply, the lower the price.

Therefore On-Balance Volume looks at both the positive effects of the total volume of an asset as well as its negative effects over a time period. It tells the trader to weigh the end price of today against the yesterday's end price to determine the future price. It also enable a trader to notice possible points of breakouts either to uptrend or downtrend.

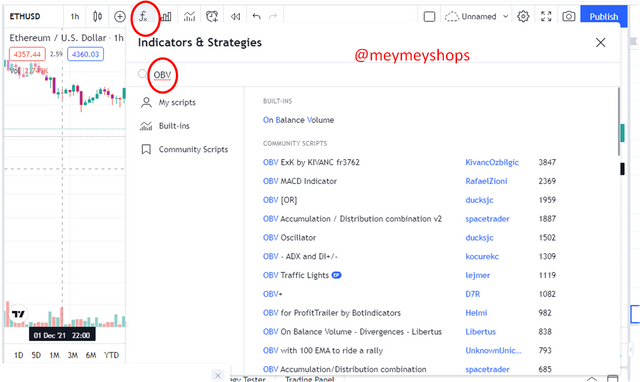

Using any charting platform of choice, add On-Balance Volume on the crypto chart. (Screenshots required).

I am using tradingview.com to add On-Balance Volume indicator.

First step: After launching the chart, I click on fx and enter OBV on the search bar

...

You can see from above charts how to add On-Balance Volume to a chart and how it moves according to the volume plugged into the market.

What are the Formulas and Rules for calculating On-Balance Indicator? Give an illustrative example.

Answering the following three question can help:

- Is the current closing price more than that of yesterday? Then add today's volume to yesterday OBV, it will give you the soonest On-Balance Volume. (OBV = previous OBV plus today's volume)

- Is the current closing price lower than the previous day? Then deduct the current volume from the last OBV to get the future OBV. (OBV = previous OBV minus current volume)

- Does today's closing price at par (equal) with the previous day's end price? Then there is a breakeven, today's OBV is same as the previous day. (OBV = previous OBV plus zero)

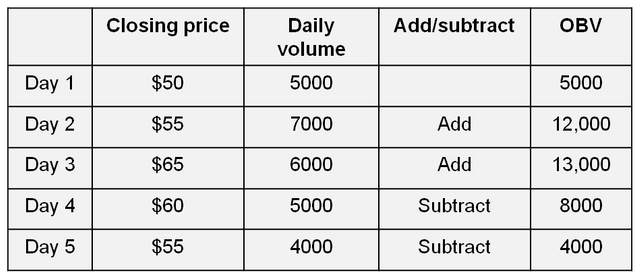

To explain more clearer using table and figures, we have:

Table prepared using Power Point

Looking at Day 2 in the table above, its closing price is higher compared to Day 1 ending price and trade volume therefore add the current trade volume to Day 1 in order to arrive at a future On-Balance. Same is application to Day 3 but in Day 4, there is reduction in both the closing price and its trade volume compared to Day 3 which was higher. Therefore a subtraction was made with Day 4 activities from Day 3 so as to predict a future On-Balance Volume.

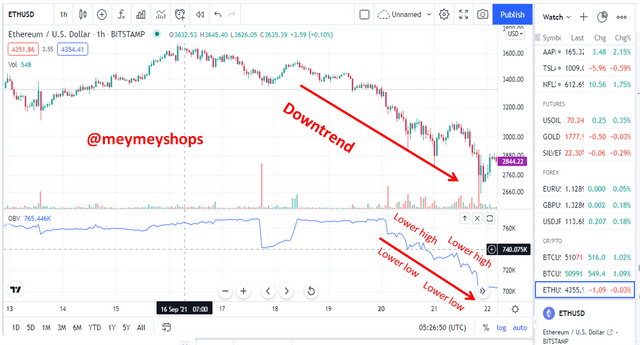

What is Trend Confirmation using On-Balance Volume Indicator? Show it on the crypto charts in both bullish and bearish directions. (Screenshots required).

A trend confirmation in the presence of On-Balance Volume indicator is when the OBV line follows the path of asset price which is affected by the volume of trade in the market. When the volume supplied is high the price of the asset goes down but if the plugged in volume is low the price rises up. This movement is confirmed by the OBV line going along the same path as the price does consistently. So OBV confirms a sell and/or a buy trend. The charts below explains more.

An Uptrend Confirmation using OBV

From this chart one can confirm that there is an uptrend because at the point of a steep up, there was a continuous move to same direction higher and higher, so do the OBV indicator follows suit confirming an uptrend where traders can go for a buy option.

Looking intently on the chart a downtrend occurs when the price slopes low and lower for some time and the OBV indicator compliments the move downward to confirm the trend. It is a good signal for selling and making profits by the traders.

What's your understanding of Breakout Confirmation with On-Balance Volume Indicator? Show it on crypto charts, both bullish and bearish breakouts (Screenshots required).

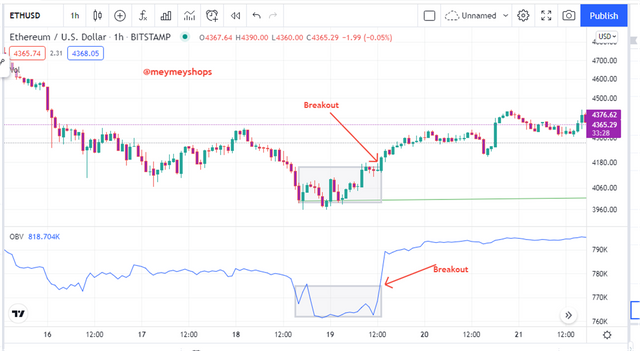

On-Balance Volume is also used to determine another strategy for trading - Breakouts. Once levels of support and resistance are identified, OBV can point out breakouts ahead of price movement to either path up/down. This action of OBV is because it targets trade volume as a yardstick for measuring price movement, so once OBV detects a volume change it can point at a breakout before the price moves. See my observation from the chart below.

The OBV spotted a breakout as price continues to move within the territory of support and resistance till it becomes obvious that a breakout is about to occur and it actually happened to Bullish trend. At this point, traders can open a buying action since the OBV has indicated such.

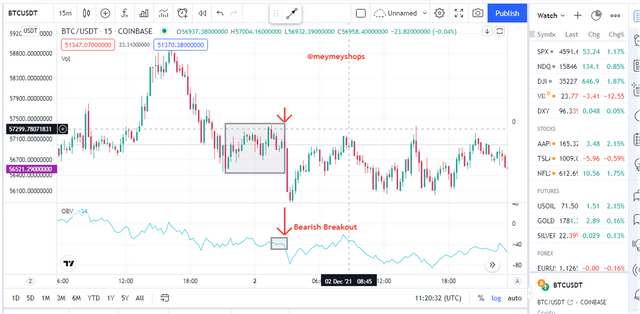

The gray box represents support and resistance levels while the red arrows represent the point at which a breakout occurs on the downward side while the OBV follows along and gives confirmation of the breakout as depicted by the second red arrow.

Explain Advanced Breakout with On-Balance Volume Indicator. Show it on crypto charts for both bullish and bearish. (Screenshots required).

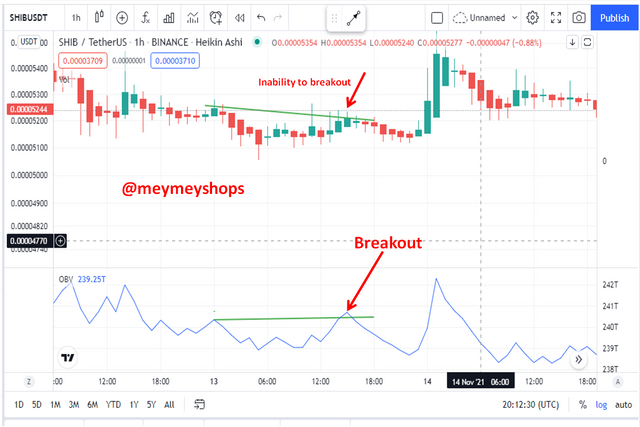

In the bullish market, advance breakout happens when price is not able to breach the last high but became weak while the OBV is the first to break the last high and cross over leaving behind the price which slowly follows it. This occurrence is a signal that at this point price is weak though volume is high and OBV is strong. This tells traders to get set for a buy.

...

In the above two charts, it is very clear that price is unable to break the last high whereas the OBV did break the previous high. Those are Advance Breakout examples.

In the bearish market, Advanced Breakout is also an inability of the price to break the last low just as the OBV does, though both are expected to walk along the same path. But price couldn't cross immediately while OBV did so in advance of price. When this happens, it's an indication that price is weak but will still crossover like OBV did.

The price in the chart is shown to be weak so was unable to break the last low but the OBV made an advance breakout.

Explain Bullish Divergence and Bearish Divergence with On-Balance Volume Indicator. Show both on charts. (Screenshots required).

Divergence with OBV indicator occurs where both price and OBV walks in separate ways, meaning that a reversal of the current trend is imminent. That is to say when price is moving at a lower low whereas OBV indicator is in the opposite direction, a higher high then there is a Bullish Divergence. Conversely, if OBV is going for lower low while its counterpart price is on the other side, higher high, it is refer to as Bearish Divergence.

In both cases, traders are expected to embrace themselves for action either for an entry or exiting the market. Usually, in an uptrend market where OBV is signaling bearish, some traders often put a stoploss on top of the last swing of the price and wait till OBV confirmation is over, watching as the trend tilts toward support before they take action.

Also in a downtrend where OBV is detecting bullish divergence, most traders take long-term trade and put a stoploss below the last swing. They may choose to hold on and watch as the OBV confirm and price moves towards resistance before action is taken.

The chart shows both bullish divergence and bearish divergence. In the first instance, price decreases while OBV is showing an increase but in the second instance, price increases as OBV signals a decrease. Both instances indicate a change in the current trend.

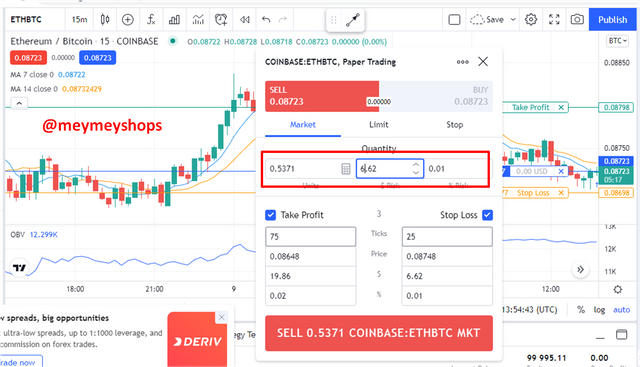

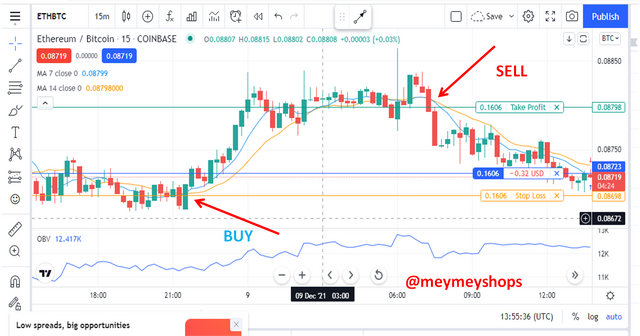

Confirm a clear trend using the OBV indicator and combine another indicator of choice with it. Use the market structure to place at least two trades (one buy and one sell) through a demo account with proper trade management. (Screenshots required).

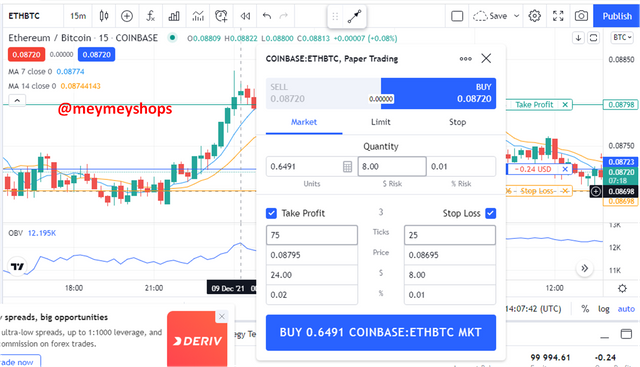

Combining two moving averages of faster period of 7 and slower period of 14 with On-Balance Volume , a clear trend was confirm as shown in the chart below. Then to determine a Buy option, a close watch at a point where there is a golden cross by the first MA (Blue) from below signals a BUY position. Whereas at the point where there is a death cross by same MA (Blue) from above over the second MA (Red), then a SELL position was taken. Check all three charts under.

The chart is a confirmation of Trend for a buy and sell positions with a combination of On-Balance Volume and two Moving Averages of 7 faster period and 14 slower period.

...

A buy position was placed

...

A sell order was placed

...

An order of a buy and sell

What are the advantages and disadvantages of On-Balance Volume Indicator?

The advantages of On-Balance Volume are listed below:

- It is not difficult to use but user friendly, this is so in that from adding it to a chart and its calculation to the its signals are all easier than most technical indicators. Granted one must have to study how it works and experiment it to get use to it.

- Time have proven OBV to work in any kind of market be it in cryptos, Futures, FX etc. in as much has such market have volume.

- It is a famous indicator that anybody can use whether a day trader, a professional trader or an investor for a long term.

- It has a shorter time lag but gives better and timely signals.

- When it give signals for a medium time period, such signals tends to be accurate.

Disadvantages

- Due to some fraudulent market makers who may at times hype their trade volumes by generating false orders only to cancel them prior to authentication, these may deceive vulnerable traders into making decisions based on falsehood.

- The method of adding and subtracting volumes are inconclusive because it does not consider the rate or percentage of price increase or decrease.

- It can send inaccurate signals if applied as a stand-alone.

- In a low volatile market with a low trading volume OBV may not be suitable.

Conclusion

Trading Crypto with On-Balance Volume indicator is a simple and effective venture in as much as a trade volume is free from a hype by its developers. The total volume at the end of each day determines the movement of price tomorrow, where there is a high volume of asset plugged into the market, the price falls but scarcity of products increases the price. The OBV takes into consideration both sides of the market effects (positive and negative) and inform the trader to weigh the two before taking a position.

Thank you my Prof @fredquantum for going through my work.

I am @meymeyshops