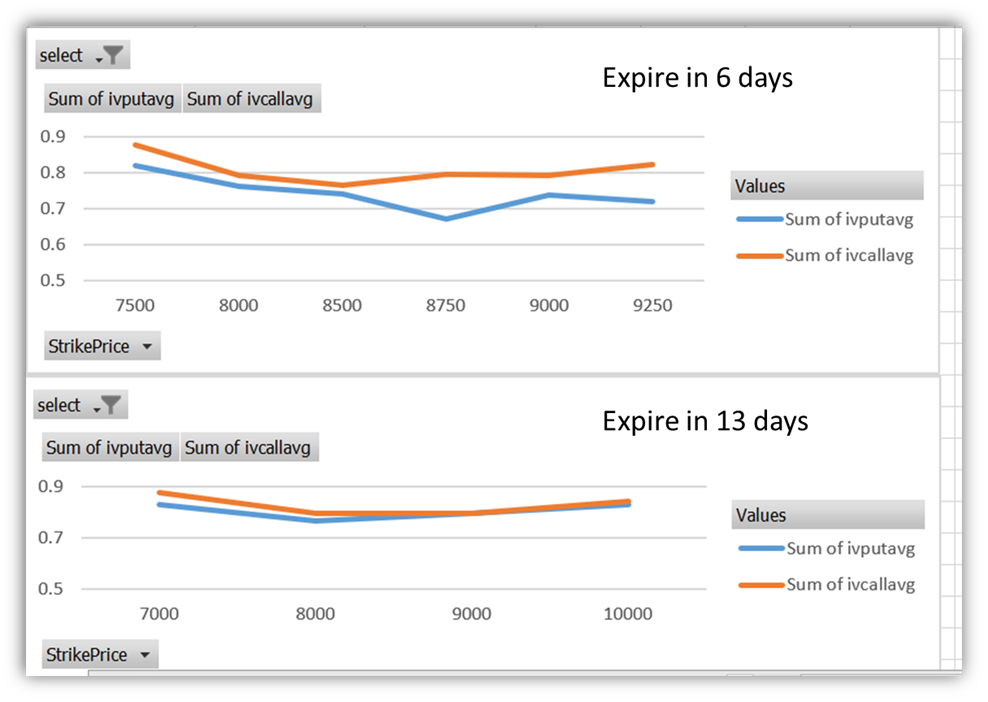

The picture above shows implied volatility distribution for call and put options for 6 and 13 days expiry for Bitcoin. Data taken from deribit. I will shortly discuss about how to interpret this data but first let us discuss about options, implied volatility, and usefulness for traders.

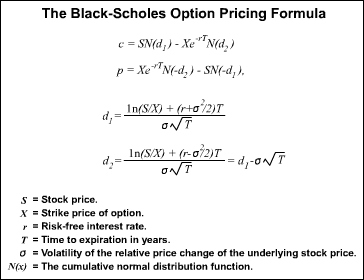

Black-Scholes formula is used to calculate the price of the options of an underlying asset.One of the most important parameter in this formula is sigma which is called implied volatility.

Under normal market behaviour the implied volatility of put options is always higher, as traders wants to hedge their positions against any negative event, than the implied volatility of the call option.

However, the implied volatility of call options does become more than put options near the bottom of corrections and when reversals from bear phase are around the corner.

I have done extensive research and analysis in this field and on that basis I had run my auto trading program for Indian Stock Market. The autotrading signals and results were published on my website VulturesPick. The overall returns were more and drawdowns were less than buy & hold.

Now with the introduction of options trading in Bitcoin as reported in my previous blog - How option and future trading Affects Volatility of underlying asset -it is possible to do that same analysis for Bitcoin. The analysis is still in preliminary stage and options liquidity is very low but worth looking at.

So now back to the chart at top showing implied volatilities for BTC options. Below are the observations:

- Implied volatility for call options is higher than that for put options for both expiries

- In general implied volatilities are higher for 13 days expiry options then for 6 days expiry options

- And implied volatility curves show typical smiley behavior

Based on the data and my research in stock market data - it is suggestive that options player on deribit are expecting that in near term BTC should go up.

I would not comment more on it but would continue doing this analysis to see how it plays out.

Stay tuned for exciting work ahead in this field.

Very technical post. I don't know if steem has community that can appreciate this stuff.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

To get off this list, please chat with us in the #steemitabuse-appeals channel in steem.chat.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This user is on the @buildawhale blacklist for one or more of the following reasons:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you! following

I am a korean

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thnk u for following

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I like your blog for my article is very support you in for a friend blog so are you friends let us mutual vote in the success of friends all the media steemit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit