What Is DOM in Trading? The Beginner’s Guide to Depth of Market

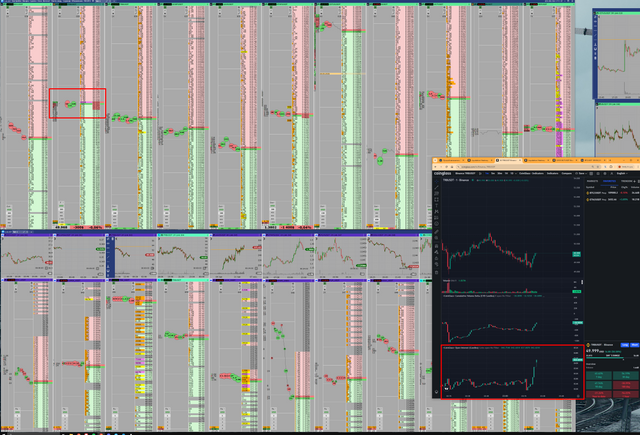

In today’s fast-paced markets, having an edge means understanding more than just charts and indicators. One of the most powerful tools used by professional traders is the DOM—short for Depth of Market. This tool offers a transparent look into market liquidity, showing you where buy and sell orders are stacked across price levels.

So, what exactly is DOM in trading—and how can it help you become a sharper, more tactical trader? Let’s break it down.

Understanding DOM: The Basics

DOM stands for Depth of Market. It’s a real-time window into the limit order book of a trading platform. Instead of just showing the current price, DOM reveals:

The number of buy orders at different price levels (bid side)

The number of sell orders above the current price (ask side)

The spread, or gap between the highest bid and lowest ask

Think of it as a digital battlefield where bulls and bears fight to dominate price.How DOM Works in Live Markets

A typical DOM interface displays two columns:

Left side (Buy orders): How many contracts/units are waiting to be bought

Right side (Sell orders): How many contracts/units are waiting to be sold

This setup is constantly changing. Traders add, cancel, or modify orders—giving clues about their intentions.

Alongside DOM, you may see the time & sales feed, which shows completed trades (i.e., market orders).

Why DOM Matters to Active Traders

DOM provides key insights you can’t see on charts:

Where large traders are placing orders

How price reacts to buy/sell pressure

Whether liquidity is strong or weak at a price level

Scalpers and intraday traders rely heavily on DOM to decide when to enter or exit based on real-time order flow.